Company Reaffirms Guidance

Houston — July 25, 2019 — Waste Management, Inc. (NYSE: WM) today announced financial results for its quarter ended June 30, 2019. Revenues for the second quarter of 2019 were $3.95 billion compared with $3.74 billion for the same 2018 period. Net income for the quarter was $381 million, or $0.89 per diluted share, compared with $499 million, or $1.15 per diluted share, for the second quarter of 2018.(a) On an adjusted basis, in the second quarter of 2019, net income was $470 million, or $1.11 per diluted share.(b) On an adjusted basis, in the second quarter of 2018, net income was $438 million, or $1.01 per diluted share.(b)

The Company’s adjusted second quarter of 2019 results exclude: a $0.15 per diluted share loss on the early extinguishment of debt, $0.04 per diluted share of non-cash charges to write-off certain assets, and $0.03 per diluted share related to the planned acquisition of Advanced Disposal Services, Inc.

The Company’s adjusted second quarter of 2018 results exclude a $0.07 per diluted share tax benefit related to income tax audit settlements and a net $0.07 per diluted share benefit primarily related to the gain on divestiture of an ancillary business.

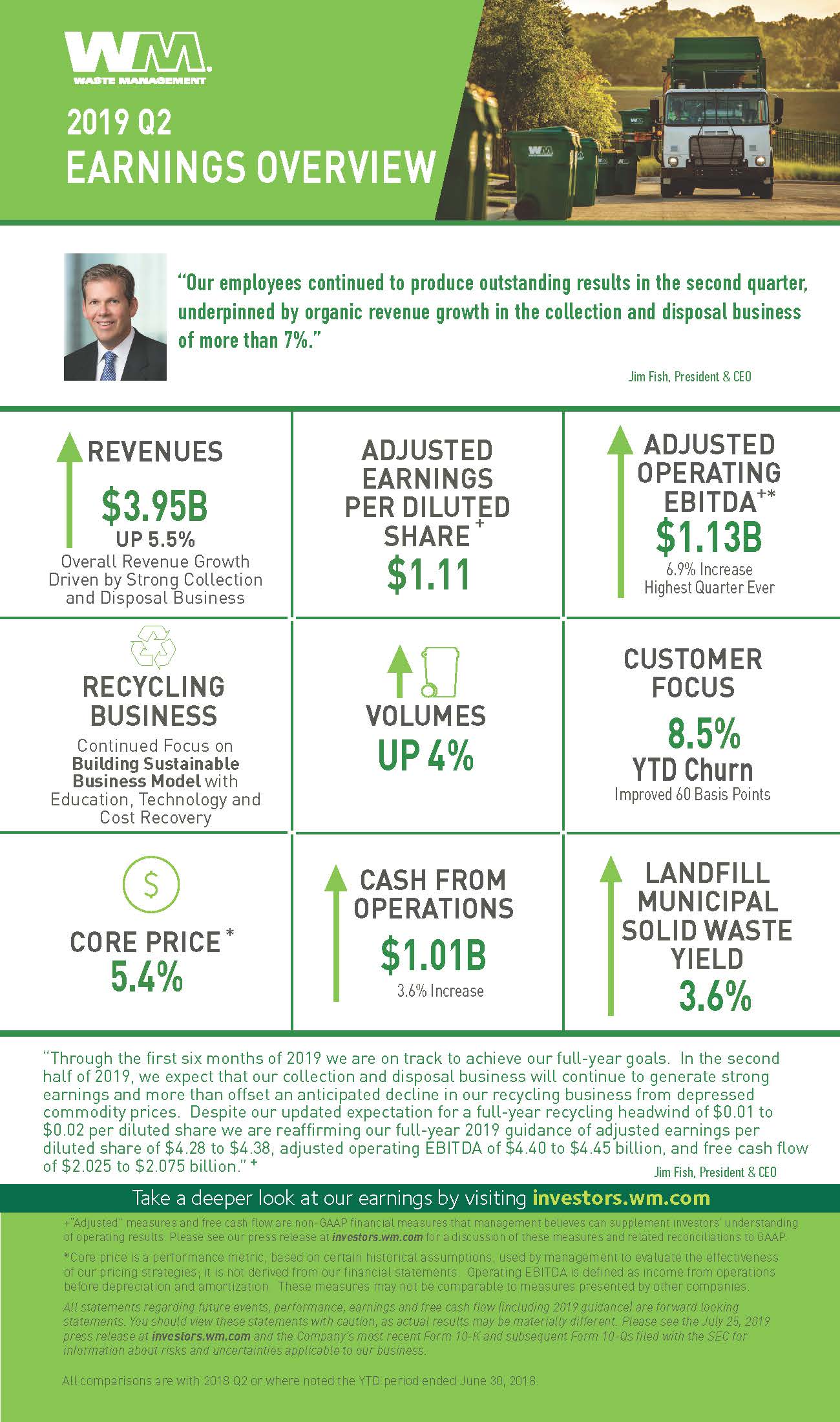

“Our employees continued to produce outstanding results in the second quarter, underpinned by organic revenue growth in the collection and disposal business of more than 7%,” said Jim Fish, President and Chief Executive Officer of Waste Management. “We leveraged growth in our collection and disposal business to expand operating EBITDA margins by 60 basis points.”

Key Highlights for the Second Quarter OF 2019

Profitability

- Total Company operating EBITDA was $1.11 billion for the second quarter of 2019, an increase of $6 million from the second quarter of 2018.(c) On an adjusted basis, total Company operating EBITDA was $1.13 billion for the second quarter of 2019, an increase of $73 million, or 6.9%, from the second quarter of 2018.(b)

- Operating EBITDA in the Company’s collection and disposal business increased $112 million, or 9.3%, in the second quarter of 2019 when compared to the second quarter of 2018.

Revenue Growth

- In the second quarter of 2019, revenue growth was driven by strong yield and volume growth in the Company’s collection and disposal business, which contributed $230 million of incremental revenue. This was partially offset by a $38 million year-over-year decline in revenue from the Company’s recycling line of business.

- Core price for the second quarter of 2019 was 5.4%, compared to 5.3% in the second quarter of 2018.(d)

- Internal revenue growth from yield for the collection and disposal business was 2.7% for the second quarter of 2019 versus 2.3% in the second quarter of 2018.

- Collection and disposal business internal revenue growth from volume was 4.4% in the second quarter of 2019. Total Company internal revenue growth from volume, which includes the Company’s recycling line of business, was 4.0% in the second quarter of 2019.

Recycling

- Operating EBITDA in the Company’s recycling line of business improved by $6 million compared to the second quarter of 2018, despite a $38 million decline in revenue. The Company was able to overcome pressure from a 33% year-over-year drop in recycling commodity prices by working to develop a sustainable business model that also meets customers’ environmental needs.

- The Company now expects the recycling business to be a $0.01 to $0.02 per diluted share headwind in 2019 compared to 2018, due to continued expected weakness in recycling commodity prices.

Cost Management

- As a percentage of revenue, operating expenses were 61.9% in the second quarter of both 2019 and 2018. On an adjusted basis, operating expenses were 61.5% for the second quarter of 2019.(b)

- As a percentage of revenue, SG&A expenses were 9.9%, or 9.8% on an adjusted basis, in the second quarter of 2019 compared to 9.8% in the second quarter of 2018.(b)

Free Cash Flow & Capital Allocation

- Net cash provided by operating activities was $1.01 billion in the second quarter of 2019, an increase of $35 million, or 3.6%, when compared to the second quarter of 2018. The growth in net cash provided by operating activities was driven by operating EBITDA growth and the Company’s focus on improving working capital, partially offset by higher taxes and interest.

- Capital expenditures were $578 million in the second quarter of 2019, a $142 million increase from the second quarter of 2018, due to an intentional focus on accelerating certain fleet and landfill spending to support the Company’s strong collection and disposal growth.

- Free cash flow was $440 million in the second quarter of 2019 compared to $621 million in the second quarter of 2018.(b) The decline in free cash flow was primarily driven by the increase in capital expenditures in the quarter attributable to year-over-year timing differences in fleet and landfill spending and a reduction in proceeds from divestitures.

- The Company paid $217 million of dividends to shareholders and repurchased $180 million of its shares in the second quarter of 2019.

- The Company spent $48 million on acquisitions of traditional solid waste businesses during the second quarter of 2019.

Taxes

- The Company’s effective tax rate for the second quarter of 2019 was approximately 23.3%.

Fish concluded, “Through the first six months of 2019 we are on track to achieve our full-year goals. In the second half of 2019, we expect that our collection and disposal business will continue to generate strong earnings and more than offset an anticipated decline in our recycling business from depressed commodity prices. Despite our updated expectation for a full-year recycling headwind of $0.01 to $0.02 per diluted share we are reaffirming our full-year 2019 guidance of adjusted earnings per diluted share of $4.28 to $4.38, adjusted operating EBITDA of $4.40 to $4.45 billion, and free cash flow of $2.025 to $2.075 billion.” (b)

————————————————————————————————————–

- For purposes of this press release, all references to “Net income” refer to the financial statement line item “Net income attributable to Waste Management, Inc.”

- Adjusted earnings per diluted share, adjusted net income, adjusted operating EBITDA, adjusted operating expenses, adjusted SG&A expenses and free cash flow are non-GAAP measures. Please see “Non-GAAP Financial Measures” below and the reconciliations in the accompanying schedules for more information.

- Management defines operating EBITDA as GAAP income from operations before depreciation and amortization; this measure may not be comparable to similarly-titled measures reported by other companies.

- Core price consists of price increases net of rollbacks and fees, excluding the Company’s fuel surcharge. It is a performance metric used by management to evaluate the effectiveness of our pricing strategies; it is not derived from our financial statements and may not be comparable to measures presented by other companies. Core price is based on certain historical assumptions, which may differ from actual results, to allow for comparability between reporting periods and to reveal trends in results over time.

The Company will host a conference call at 10 a.m. (Eastern) today to discuss the second quarter results. Information contained within this press release will be referenced and should be considered in conjunction with the call.

The conference call will be webcast live from the Investor Relations section of Waste Management’s website www.wm.com. To access the conference call by telephone, please dial (877) 710-6139 approximately 10 minutes prior to the scheduled start of the call. If you are calling from outside of the United States or Canada, please dial (706) 643-7398. Please utilize conference ID number 4598118 when prompted by the conference call operator.

A replay of the conference call will be available on the Company’s website www.wm.com and by telephone from approximately 1:00 PM (Eastern) today through 5:00 PM (Eastern) on Thursday, August 8, 2019. To access the replay telephonically, please dial (855) 859-2056, or from outside of the United States or Canada dial (404) 537-3406 and use the replay conference ID number 4598118.

about waste management

Waste Management, based in Houston, Texas, is the leading provider of comprehensive waste management environmental services in North America. Through its subsidiaries, the Company provides collection, transfer, disposal services, and recycling and resource recovery. It is also a leading developer, operator and owner of landfill gas-to-energy facilities in the United States. The Company’s customers include residential, commercial, industrial, and municipal customers throughout North America. To learn more information about Waste Management, visit www.wm.com or www.thinkgreen.com.

Forward-Looking Statements

The Company, from time to time, provides estimates of financial and other data, comments on expectations relating to future periods and makes statements of opinion, view or belief about current and future events. This press release contains a number of such forward-looking statements, including but not limited to statements regarding 2019 earnings per diluted share; 2019 operating EBITDA; 2019 free cash flow; and all statements regarding future performance of our collection and disposal business, recycling business or otherwise. You should view these statements with caution. They are based on the facts and circumstances known to the Company as of the date the statements are made. These forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those set forth in such forward-looking statements, including but not limited to, increased competition; pricing actions; failure to implement our optimization, growth, and cost savings initiatives and overall business strategy; failure to identify acquisition targets and negotiate attractive terms; failure to consummate or integrate the acquisition of Advanced Disposal Services, Inc. or other acquisitions; failure to obtain the results anticipated from the acquisition of Advanced Disposal Services, Inc. or other acquisitions; environmental and other regulations; commodity price fluctuations; international trade restrictions; disposal alternatives and waste diversion; declining waste volumes; failure to develop and protect new technology; failure of technology to perform as expected; preventing, detecting and addressing cybersecurity incidents; significant environmental or other incidents resulting in liabilities and brand damage; weakness in economic conditions; failure to obtain and maintain necessary permits; labor disruptions; impairment charges; and negative outcomes of litigation or governmental proceedings. Please also see the Company’s filings with the SEC, including Part I, Item 1A of the Company’s most recently filed Annual Report on Form 10-K as updated by our subsequent quarterly reports on Form 10-Q, for additional information regarding these and other risks and uncertainties applicable to its business. The Company assumes no obligation to update any forward-looking statement, including financial estimates and forecasts, whether as a result of future events, circumstances or developments or otherwise.

Non-GAAP Financial Measures

To supplement its financial information, the Company, in some instances, has presented adjusted earnings per diluted share, adjusted net income, adjusted operating EBITDA, adjusted operating expenses, adjusted SG&A expenses and free cash flow, and has also presented projections of adjusted earnings per diluted share, adjusted operating EBITDA, and free cash flow; these are non-GAAP financial measures, as defined in Regulation G of the Securities Exchange Act of 1934, as amended. The Company reports its financial results in compliance with GAAP but believes that also discussing non-GAAP measures provides investors with (i) additional, meaningful comparisons of current results to prior periods’ results by excluding items that the Company does not believe reflect its fundamental business performance and are not representative or indicative of its results of operations and (ii) financial measures the Company uses in the management of its business.

The Company’s projected full year 2019 earnings per diluted share, and operating EBITDA are anticipated to exclude the effects of events or circumstances in 2019 that are not representative or indicative of the Company’s results of operations. Such excluded items are not currently determinable, but may be significant, such as asset impairments and one-time items, charges, gains or losses from divestitures or litigation, and other items, including transaction costs related to the pending acquisition of Advanced Disposal Services, Inc. Due to the uncertainty of the likelihood, amount and timing of any such items, the Company does not have information available to provide a quantitative reconciliation of adjusted projected full-year earnings per diluted share or operating EBITDA to the comparable GAAP measures.

The Company discusses free cash flow because the Company believes that it is indicative of its ability to pay its quarterly dividends, repurchase common stock, fund acquisitions and other investments and, in the absence of refinancings, to repay its debt obligations. Free cash flow is not intended to replace “Net cash provided by operating activities,” which is the most comparable GAAP measure. The Company believes free cash flow gives investors useful insight into how the Company views its liquidity, but the use of free cash flow as a liquidity measure has material limitations because it excludes certain expenditures that are required or that the Company has committed to, such as declared dividend payments and debt service requirements. The Company defines free cash flow as net cash provided by operating activities, less capital expenditures, plus proceeds from divestitures of businesses and other assets (net of cash divested); this definition may not be comparable to similarly-titled measures reported by other companies.

The quantitative reconciliations of non-GAAP measures used herein to the most comparable GAAP measures are included in the accompanying schedules, with the exception of projected earnings per diluted share and projected operating EBITDA. Non-GAAP measures should not be considered a substitute for financial measures presented in accordance with GAAP.

FOR MORE INFORMATION:

Web site www.wm.com

Analysts

Ed Egl, 713.265.1656

eegl@wm.com

Media

Andy Izquierdo, 832.710.5287

aizquierdo@wm.com

###